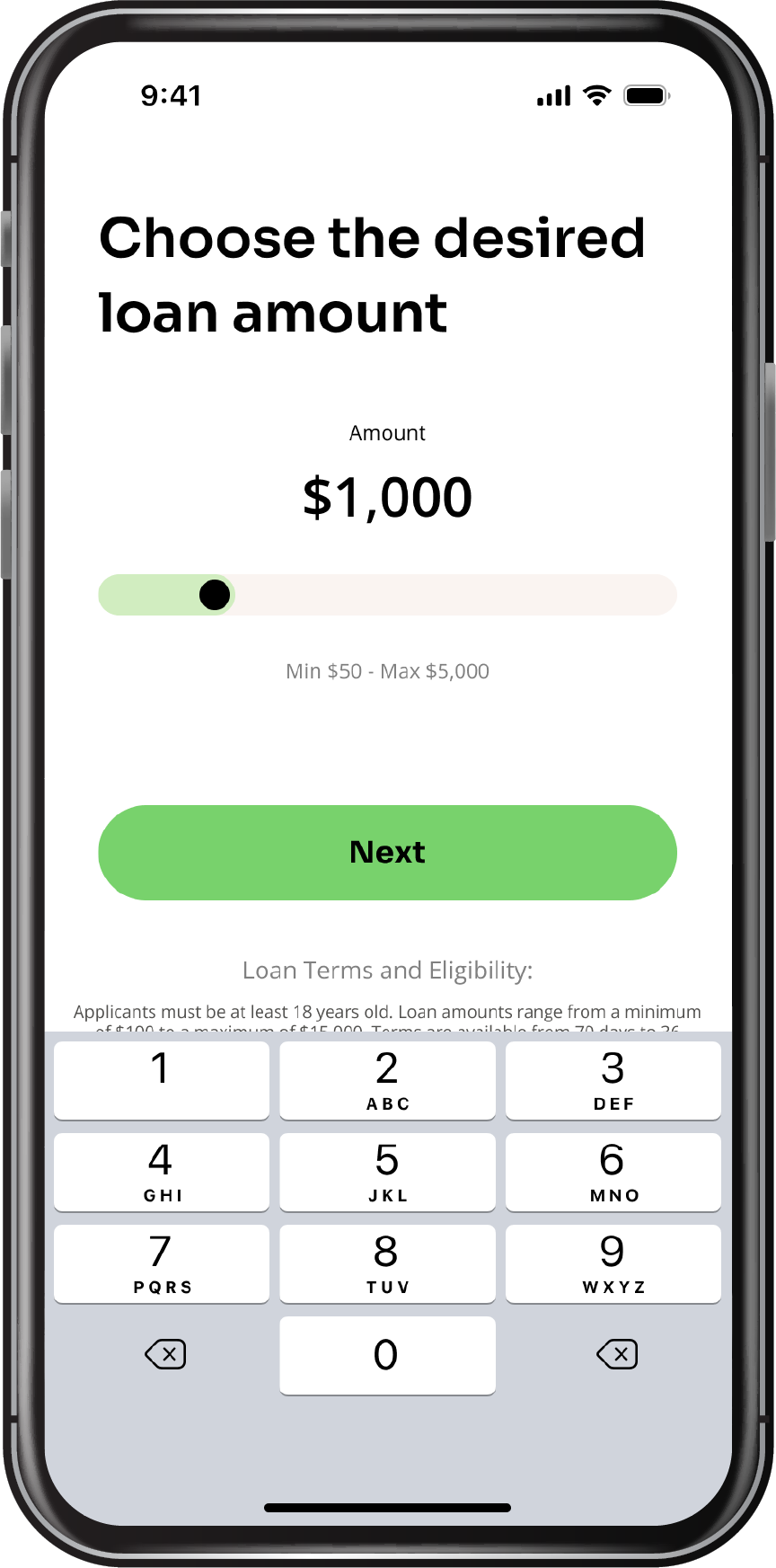

SDC is dedicated to providing a seamless platform that connects you to reliable lenders for your microloan needs. We do not provide loans ourselves but connect you with qualified lenders who offer quick financial solutions, even if your credit history is not perfect.

Amazing Features

Free Support

Our team is here to help you at every step, answering questions and guiding you to the best lender for your needs.

No Fee

Enjoy peace of mind with no hidden costs — our service is completely free for you.

Credit history irrelevant

We focus on connecting you with lenders who understand your needs, regardless of your credit score.

About SDC